Key Insight 1: Stay Ahead in Diverse Markets with Strategic Regional Adaptation

As the FinTech ecosystem continues to expand globally, working in various regions often requires you to consider your end users as much as you consider your regional partners or gatekeepers.

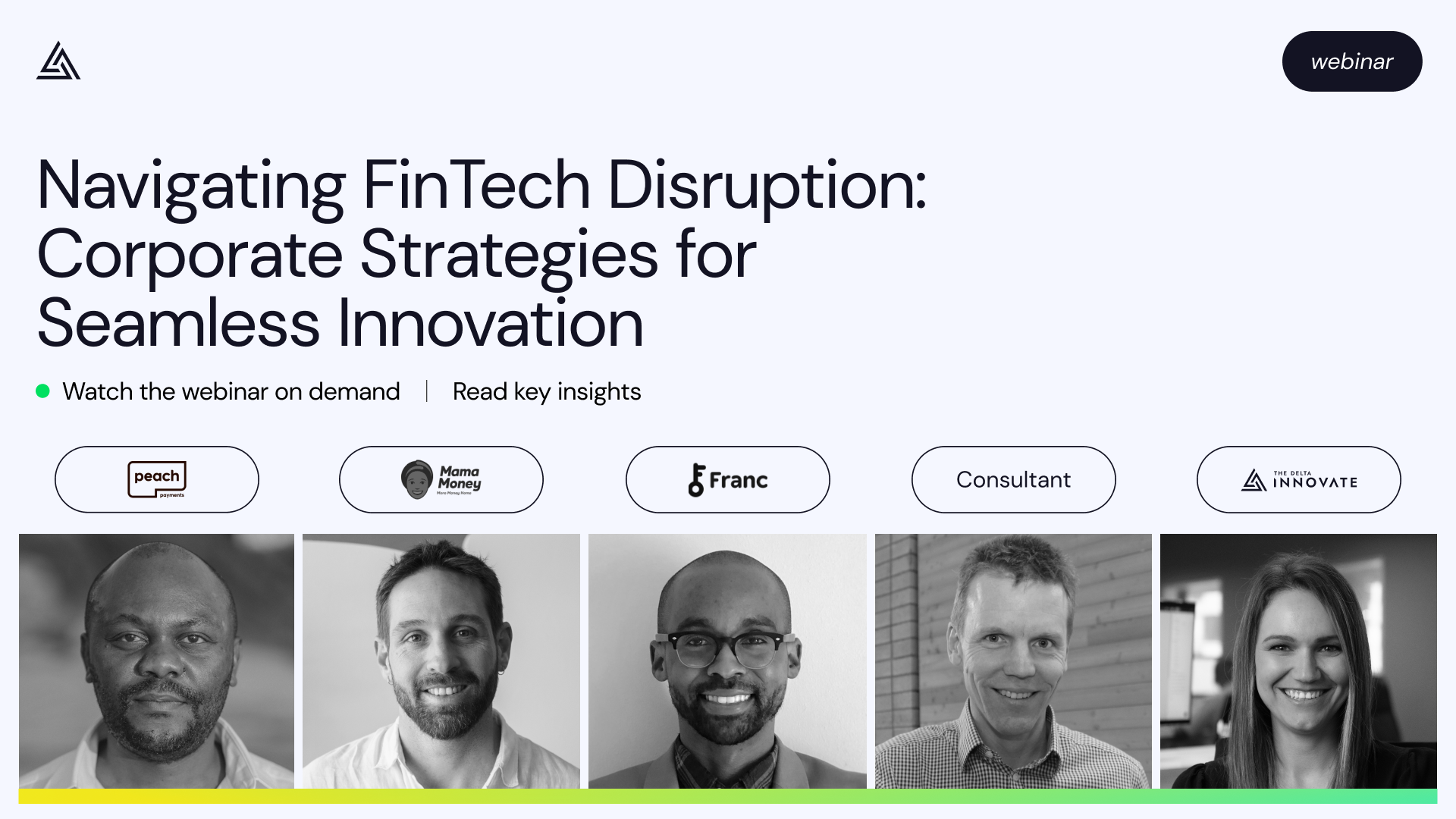

Kinsley Ndenge, Product Manager at Peach Payments, helped us understand the importance of keeping a focus on the end-user.

Regional adaption tips include:

- Ensure you have good representation within the various payment methods used in the regions you’re operating within.

- Be aware of the preferred payment method of the customers in the region.

- Ensure your offering includes value-added services that specifically serve your merchants.

Key Insight 2: Identify Seamless Integration Strategies

Finding your ideal seamless integration strategy may sound like a lot of time and effort, initially, but this can be as simple as identifying the regional chat app, like WhatsApp. This approach capitalises on familiar platforms, enhancing user experience in the FinTech landscape.

At Delta Innovate, we highly recommend this approach as we believe you can be agile and learn more about your users (more efficiently and at a faster pace) by leveraging tools that you do not need to build.

Mathieu Coquillon, Director of Mama Money, illustrated the strategic use of a WhatsApp bot for seamless integration at his FinTech startup:

“The choice of a WhatsApp bot seemed crazy at the time but the reasoning was that there was this marriage between traditional finance - which is banking - and a new innovative technology. Our customers have never used the banking application before but they do use WhatsApp every day of their life.”

Key Insight 3: Build Strong Value Propositions Despite Imminent Challenges

With the rate at which the FinTech ecosystem is scaling and adapting to users’ needs, there are often imminent challenges to launching new value propositions.

To name a few of these complexities:

- Partnerships - sometimes integrated partnerships will exit/ask to be removed.

- User adoption - initially, it is always tough getting initial traction.

- UX blocker - users needed to ‘approve’ the deposit/debit order and they sometimes weren’t available.

Ashraf Stakala, Head of Product at Franc, shared his insights on navigating the complex terrain of launching innovative FinTech products and services, underscoring the importance of flexibility and user-centred design:

“There are always going to be these complexities. Which sometimes ends up in a case of actually removing a partner or removing a feature you thought would work. You learn how to work around these.”

Key Insight 4: Overcome Common Challenges of Corporates / Startup Collaboration

Although there is huge value in traditional financial corporations and FinTech startup collaboration, there are also various challenges that are often faced.

Top challenges:

- Corporates and startups speak different languages with different cultures.

- Startups are more focused on their goals and their runway.

- Startups can move faster or with more agility and can be blocked by corporations.

To solve these challenges, Paul Mitchell, Consultant and Blockchain Strategist, suggests the following:

- Keeping communication lines open (from both parties).

- Establishing focus and direction by defining what both sides’ measures of success look like (that work for both the corporate and startup).

When considering the main blockers when working from a corporate perspective, Paul recommends that startups communicate regularly about what they need (for example: cash flow and to be paid on time as the startup simply cannot function without this).

From a startup’s perspective, Paul suggests that corporations make it easy for startups to work with them (essentially, startups need an internal corporate ‘advocate’ or employee/team member to make the process of collaboration with the corporation easier and simplified).

“Corporates need to help startups understand their industry, problems and your business because it’s very easy to assume everybody understands what your business does and cares about this. Often, anyone outside of the business actually understands the inner workings of what you do, daily.” - Paul Mitchell, Consultant and Blockchain Strategist

Key Insight 5: Consider your End-User when Merging Traditional Finance and Modern-Day Tech

When merging traditional financial features or structures with modern-day tech, one needs to be very aware of customer needs and requirements. At Delta Innovate, we suggest you take time to assess the biggest pain points and accessibility issues for your end-user, before merging and working on any new technology.

For example, while trying to navigate how to do cross-border remittances, Mathieu Coquillon, Director at Mama Money, worked with a regulator entity and used a traditional module to initially get set up according to standards (regulated).

However, as both of Mama Money’s founders noticed that mobile money was gaining traction at the time, a mobile wallet seemed like a better option to serve their current customers’ needs and resolve their pains.

Customers were experiencing challenges of:

- Speed of delivery of the transaction (because remittances are often used for emergency situations)

- Last-mile challenge (Africa is still working within a third-world space - so if customers are sending money over the weekend and then need to go into a city)

In turn, Mama Money considered the pains and requirements of their users to make use of a wallet that can send and receive money really fast, as well as cut the stress and administration of last-mile challenges.

Key Insight 6: Choose and Measure Relevant Metrics

There are a number of metrics that can be used to measure the success of launching a new value proposition, from number of sign-ups to paying customers or social media engagement. However, one must ensure that they are choosing a metric that directly indicates the scalability of your value proposition in the region.

Ashraf Stakala, Head of Product at Franc, holding experience at Yoco and SnapScan explained the main metrics that he considers ‘success’:

“I believe that First-time Adoption as a metric speaks to the accessibility of your product. This might not be seen in a KPI document or in a boardroom report, but I consider this as a success based on its accessibility to the user.” - Ashraf Stakala, Head of Product at Franc

Definition

First-time adoption - The number of users/people using the technology for the first time.

Practical examples

This stimulated an interesting conversation between the panellists, as they began thinking about how Franc is tapping into existing customers and finding and converting new customers. More importantly, the panellists began explaining how one needs to ensure they are making their products as accessible for their target audience as possible.

For example, Mathieu Coquillon, Director at Mama Money, explained how he got to know the intricacies of what his target audience needed when his assumptions were tested: “We take for granted just walking into a bank. When I talk to people in the informal sector, many have never been into the bank but they talk about the most educated family member doing this. This is where traditional banks really get it wrong. They make the accessibility to come to them and get people through the door so difficult.”

This is why Mathieu chose to get Mama Money’s products directly in front of the target audience they’re working with: “The informal market is right there - right in their neighbourhood. It’s easy to access, I don’t need to put on my Sunday best and it’s in my local language. When creating your products' accessibility - I would question how you are taking the product to people rather than asking them to come to you?”

Key Insight 7: Identifying Failing Strategies in Africa

As Africa leads as the globe's fastest-growing continent in FinTech revenue, boasting a remarkable compound annual growth rate (CAGR) of 32% (according to a recent report by Boston Consulting Group (BCG) and QED Investors), identifying the right strategies to launch is this region is absolutely essential.

Paul Mitchell, Consultant and Blockchain Strategist, explained how strategies are often not transferable across regions (especially across countries, globally). Paul also warned the audience about taking our assumptions to new countries and spaces where they are invalid.

“In some ways, we’re behind [in South Africa] and in other ways, we’re more sophisticated than first-world countries in our financial circumstances. Like SnapScan or Yoco for example doing great things here. However, in America, the waitron still walks away with your credit card to make a payment and that is absolutely terrifying,” Paul describes.

Strategies and innovations are often built on the current context one finds themselves within, which includes:

- Economic context

- User behaviour

- Competitors

- Regulations and standards

- Cultural contexts

“There is a big education thing - whether that be the user or a need for educating the regulator. We’ve got to learn, teach and communicate to adapt to the context.” - Paul Mitchell, Consultant and Blockchain Strategist

In turn, Paul suggests that companies “Go with the grain”, explaining that “If you can find things that people are already doing, informally, to plug gaps that you are trying to build products for - then piggyback on that. Build and work with that solution.”

Key Insight 8: Improving FinTech Startups’ Mentality and Standards

As has already been mentioned, startup and corporation cultures and mentalities often differ, vastly. However, both sides bring important perspectives when launching a new FinTech value proposition.

Kinsley Ndenge, Product Manager at Peach Payments, highlighted the importance of tailoring FinTech solutions to meet both regional business requirements and end-user preferences, emphasising a user-centric approach in diverse markets.

“Startups can deal with a little more ambiguity and take more risk. Yet, most startups are still trying to create value because that becomes income for you or you won’t have a business. This puts you in a place to experiment more, which corporations often lack. ” - Kinsley Ndenge, Product Manager at Peach Payments

However, Kinsley also reiterated that startups still need to meet the corporate or global standard of support and regulation, in order to gain buy-in from your customers and retain them.

Kinsley explained how “(Startups) need to provide world-class support across multiple channels. Even as a startup, you still need to meet the highest regulatory standards.”

.jpeg)

.jpeg)